In my last post I covered the proliferation of challenger banks, the mobile-first, digital-only neo-banks and what differentiates them from the incumbents. While the media lens is usually focused on the front-end, the user experience, I’m always curious about what’s powering these operations under the hood.

From the traditional banks’ perspective, fintech companies are just a front-end customer acquisition tool and source of cheap deposits, or a potentially strategic partner, nimble enough to keep the incumbent ahead of the curve and remain relevant.

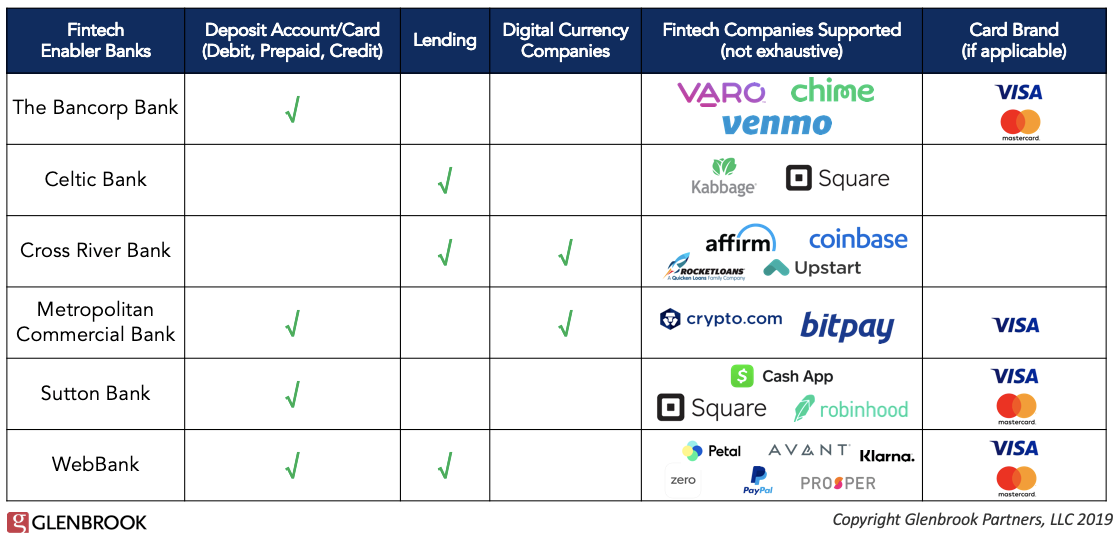

There is a category of banks I call the “fintech enabler banks,” or, “small banks you’ve never heard of” that power much of the fintech industry. These banks operate largely behind the scenes, partnering with challenger banks or fintech firms that serve specific verticals—think online lending or wealth management—in order to offer adjacent banking products and services.

Behind the Scenes

A closer inspection reveals two approaches these enabler banks take in support of their innovative partners:

The Traditional Partner Bank

The first is the traditional bank sponsor approach. These banks leverage their license to:

- Hold FDIC-insured deposits

- Issue cards via BIN sponsorship

- Originate loans

- Offer cryptocurrency companies access to bank accounts and ACH/wires (which larger banks might not entertain)

- Provide guidance on regulatory compliance

The Bancorp Bank, WebBank, and Cross River Bank are well-known for supporting fintech companies in this way while sticking to their core competencies.

The Tech-Friendly Partner Bank

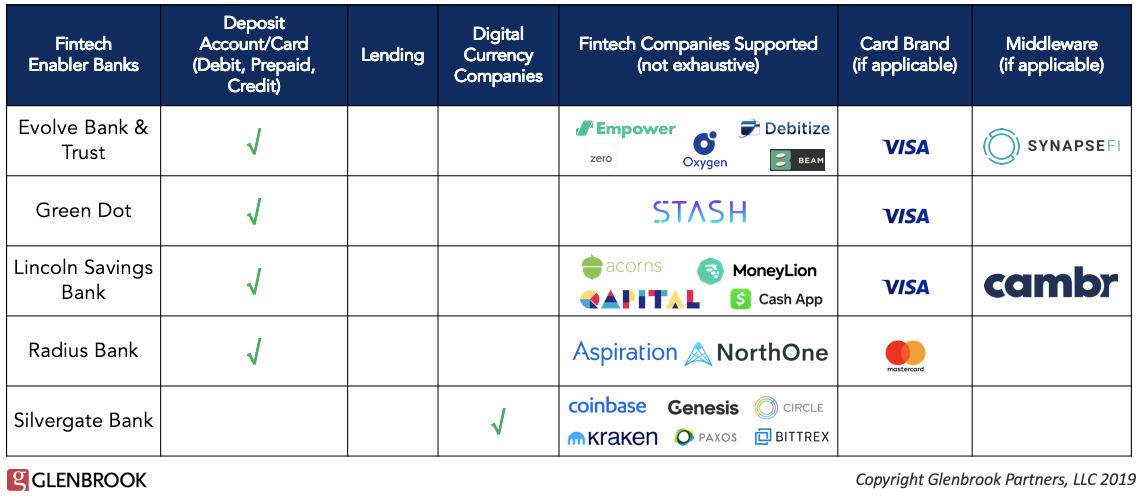

The second is a handful of banks that provide similar activities, but also leverage APIs and middleware to differentiate their offerings. Some may even have a dedicated “fintech business unit.” A few financial institutions of note in this latter category are Evolve Bank and Lincoln Savings Bank.

Let’s evaluate each approach in more depth.

The Traditional Path in Depth

Key distinguishing features:

- BIN sponsorship: BINs (Bank Identification Numbers) are assigned to banks via the card networks to uniquely identify the issuer and allow network members to process payments. Banks can “rent” BINs to non-financial entities, thereby enabling them to create and manage their own card programs. Recently, a slew of fintech companies have issued ancillary debit cards through such BIN sponsorship arrangements.

- Compliance: The partner bank does the majority of the heavy lifting when it comes to compliance, operations, customer service, and other back-office functions. Federal law requires that banks perform KYC/AML procedures for any customer acquired via a fintech front-end application.

Examples include:

- The Bancorp Bank supports both digital-only challenger banks like Varo and Chime while also issuing the Venmo debit card.

- WebBank powers Zerocard from Zero Financial (a credit card that acts like a debit card – the checking account is actually held at Evolve Bank) as well as the Petal credit card. On the lending side, WebBank is the lender behind PayPal Working Capital and Business Loans, Klarna’s POS installment loans, and more.

Note: Robinhood has since backtracked on its checking/savings/card issuance plans

The Tech-Friendly Path in Depth

Key distinguishing features:

- These banks provide the traditional functions and add technology vendor selection. BIN sponsorship, compliance, and back-office functions are the basics, but they also engage with middleware providers and technology companies. As a result, they offer “open APIs” that make the bank’s infrastructure easier to work with.

- Fintech-focused business units are an emerging organizational strategy taken to capitalize on today’s fintech momentum by creating a unit dedicated to servicing and collaborating with fintech companies.

Examples include:

- Evolve Bank has partnered with middleware provider, SynapseFI, to offer various flavors of digital banking:

- SynapseFI’s website states: “Synapse provides payment, deposit, lending, and investment products as APIs to fintech companies who build and launch their financial innovations on top of our banking infrastructure”

- The Evolve and SynpaseFI combination is used by Empower, Beam, Oxygen, and Debitize (acquired by Trim)

- Lincoln Savings Bank created LSBX, a fintech support venture based on Q2’s CorePro platform. Q2’s CorePro platform is part of broader joint venture with StoneCastle Partners, a deposit network of over 800 community banks, called Cambr

- Cambr bills itself as the “full-stack financial toolkit with open APIs”

- Notable fintech companies building with Cambr include MoneyLion, Acorns, Qapital, Joust

Note: Debitize has been acquired by Trim; Aspiration formerly partnered with Radius Bank, but now has a relationship with Coastal Community Bank

Radius Bank stands out as it has shifted from traditional bank to tech-forward bank. In addition to supporting fintech companies’ checking account and debit card offerings, Radius has also re-evaluated its strategy, and now partners with several fintech companies to enhance its own direct-to-consumer/business offerings. It eliminated all branches several years ago and is keenly focused on digital. A few notable partnerships include:

- Treasury Prime to power Radius Bank’s online account opening for business checking (“Tailored Checking”)

- Alloy + Mantl to facilitate automated online account opening for consumer checking

- Narmi to provide an enhanced consumer online and mobile banking experience for Radius customers

Symbiotic Relationships

I once read a quote in an interview with Nick Ogden, the founder of Worldpay: “All fintechs need a bank, not every bank needs a fintech.”

Many fintech companies were born out of frustration with traditional financial services. Despite new front-end features and tools, these products were largely built on aging technology using a traditional bank’s charter to execute on that vision. That model is starting to change as newer middleware and core systems providers—as well as the (still uncertain) OCC fintech charter application process—enter the ecosystem.

I will be watching for companies that are built from the ground up: completely independent, with their own banking license, using a modern core platform, and delivering the customer experience today’s incumbents have yet to master.

Until their arrival, bank and fintech collaboration will continue to flourish. In particular, traditional banks that do not have the budget or resources to build new capabilities in-house will increasingly rely on fintech solutions, either via partnership or acquisition, to expand their capacity for innovation.