Fintech startups have begun a phenomenon some call the “unbundling of financial services” through standalone products such as unsecured consumer loans, credit cards, checking and savings accounts, or personal financial management tools. A cohort of entities known as “challenger banks” or “neo-banks” have also entered the market in an attempt to take on digital banking itself with user-friendly product bundles that include checking, savings, debit, and money management tools.

How different are these solutions and their technology? Which ones are better in terms of the overall experience and why?

Copyright Glenbrook Partners, LLC 2019

Defining Challenger Banks

First, what exactly are challenger banks, and what differentiates them from the incumbents? A characteristic of challenger bank I define is a company that offers a mobile-first, digital-only application. These apps tend to have modern UIs and features aimed at helping consumers save and better manage their money. Significant venture capital investment and multi-million-dollar valuations (even “unicorn” status of $1B+ valuations has been reached) are additional characteristics. There are no physical branch locations, and they typically partner with Durbin-exempt financial institutions that sit in the background to provide favorable card issuing economics. In certain instances, a challenger will apply for its own bank charter and partner with a modern core software vendor (e.g. Varo Money). The fintech banking apps tend to distinguish themselves by touting “honest and transparent” financial services, with low or no-fee products.

Already a Crowded Market and the Incumbents are on Alert

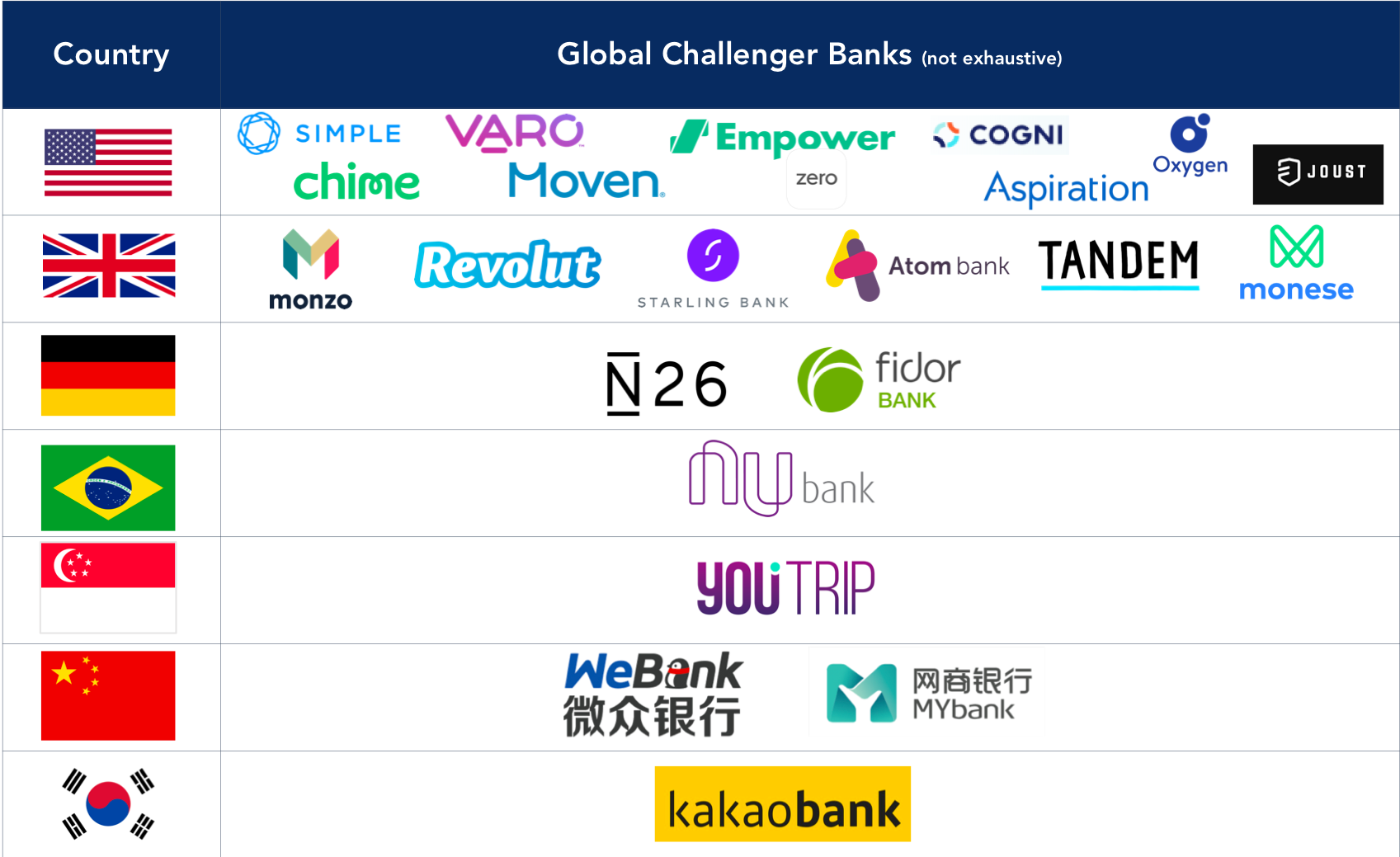

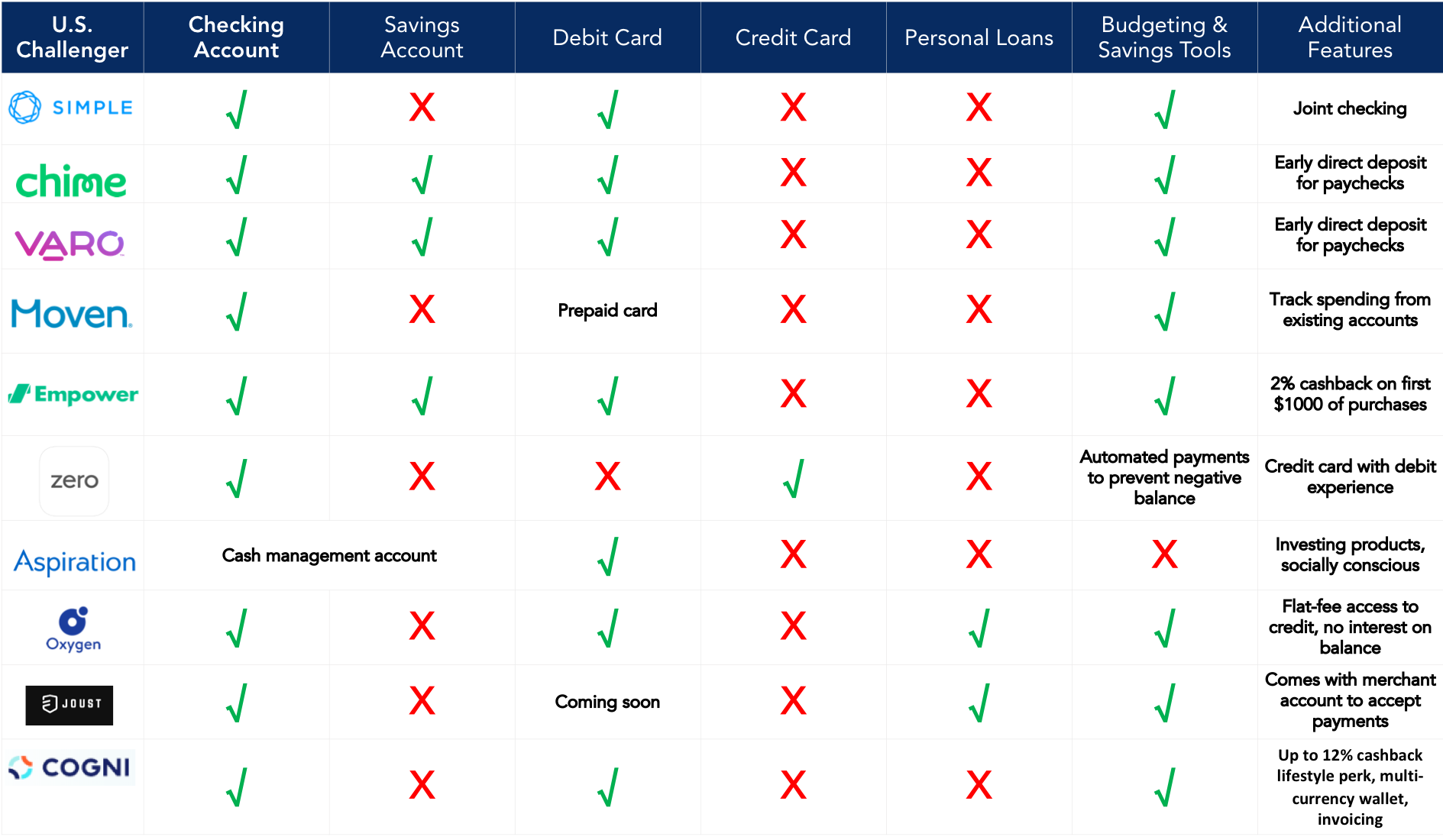

The digital banking landscape is already heavily saturated. Many challenger banks offer similar features, fee-free amenities, and higher-than-average interest rates. Additionally, it appears that fintech firms not traditionally involved in banking now offer checking, savings, and debit cards and, in some cases, cash management accounts.

Given the plethora of options currently available in the U.S., it’s valuable to take a look at how the non-U.S. entrants such as N26, Monzo, and Revolut attack the market with something unique and value-add. Certain firms try to serve specific niches such as the gig economy, freelancers, or the unbanked/underbanked to potentially help them stand out against the incumbents’ mass-marketed digital banking offerings.

Copyright Glenbrook Partners, LLC 2019

Some might argue there isn’t a tremendous amount the challengers are doing that the incumbents can’t emulate, assuming the incumbents’ technology teams are nimble and investment allocation substantial. Incumbents such as JP Morgan Chase and Wells Fargo have begun to react to this industry shift:

- Chase launched Finn, which is heavily targeted towards millennials. There is an ability to “rate” transactions with emojis (similar to Venmo’s social bent), as well as track spending trends and create savings rules.

- More recently, Wells Fargo launched their version of a digital banking app called Greenhouse, which claims to be for the gig economy. Greenhouse offers a way to segregate funds via two separate checking accounts – one called “Spend” and the other called “Set Aside” to help manage bill payment and foster general savings habits. Both accounts are linked to the same debit card.

Challenging the Challengers

As a customer of both institutions, and having downloaded both of these apps, I find each bank’s traditional mobile banking app is more feature-rich than their digital experiments. Finn and Greenhouse also seem light on the features compared to their fintech competitors such as Simple’s money management and budgeting tools, Aspiration’s Impact Measurement, or Zero’s debit/credit hybrid offering. To me, Joust stands out the most with its tailored focus on “solopreneurs,” providing banking, payments, merchant processing, and invoice factoring in one platform.

Despite the appearance of innovation on the front end, the back-end infrastructure of both the challengers and the incumbents is, for the most part, a morass of cumbersome, legacy software. There is a limit to how much companies can innovate if their solutions are built on top of a prior generation’s technology stack. For example, Wells Fargo was recently ridiculed for a disastrous outage, which allegedly led several users to sign up for accounts with Chime. A few weeks later, however, Chime also experienced an outage.

Ultimately, I wouldn’t be surprised to see continued consolidation. Simple’s acquisition by BBVA Compass is an example. I wonder about the sustainability of the challenger bank business model and how it can generate sizable revenue beyond interchange fees and interest income on account balances. Chime’s latest funding round may indicate that investors believe there is money to be made through expansion into lending and credit.

I’ll be watching the challenger bank story closely as it unfolds. After all, there are thousands of traditional banks and financial institutions in the U.S., so what’s another 10-30 digital banking apps duking it out for market share?

Are these digital banking apps all slightly modified versions of the same offering? Do you have direct experience using any of them, and if so, do you find them more useful than a traditional bank’s mobile banking app? I’d love to hear your thoughts!