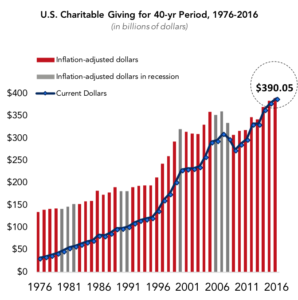

Tax Day has come and gone, and Americans have filed our returns and many of us even took the time to itemize our charitable contributions. According to the IRS, these contributions totaled over $390B in 2016 – a new record year of giving. While the rise in giving is welcome news, nonprofits also have to contend with the rise in payments challenges that comes with processing these donations.

Nonprofit organizations lack the resources of the average merchant, but both grapple to address the needs of consumers in an increasingly complex omnichannel environment. While some payments challenges mirror what is seen in eCommerce, there are still several challenges unique to nonprofits that may require more focused solutions from payments providers.

Source: Giving USA 2017, The Annual Report on Philanthropy

With charitable giving at an all-time high, we will investigate five critical payments challenges facing our favorite nonprofits.

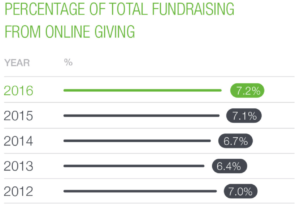

Challenge #1: Driving growth of online and mobile donations

Online fundraising for nonprofits is often stifled by constrained resources and many also lack the system integration needed to further fuel online growth. Online giving is outpacing the growth of overall giving but lagging the numbers seen in eCommerce. eCommerce as a share of total U.S. retail sales rose to 8% in 2016 whereas online giving fell behind to about 7% in 2016. Since 2013, eCommerce share has grown more than twice that of online giving.

Source: Blackbaud, “2016 Charitable Giving Report”

So why is that – where is the downward pressure coming from?

It’s many of the same challenges facing all merchants – lack of a user-friendly, mobile-optimized payments experience. According to NonprofitSource, organizations can expect more than 100% increase in donations by adopting a mobile-friendly website. However, nonprofits may not have the technical expertise or resources to embed a mobile-optimized payment page directly within their website. That’s where third-party processors can step in. By focusing on two aspects of the payment experience: providing the ease of new payment methods, including digital wallet enablement, and ensuring a few clicks to initiate or confirm a recurring donation, nonprofits will benefit from increased ‘close rates’.

To help visualize, the below donation pages from the American Red Cross show an optimized browser checkout page on a computer and a more streamlined view on a mobile device.

Source: CauseVox, “7 Steps to Ensure Your Nonprofit has a Mobile-friendly Website

For nonprofits, nearly half of website traffic and 25% of donors are driven by mobile so getting this right is certainly a priority.

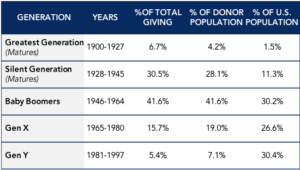

Challenge #2: Changing demographics and the rise of third-party peer-to-peer (P2P) and crowdfunding platforms

As in all things payments, demographics matter for nonprofits. Millennials (Generation Y) are projected to account for 50% of the workforce by 2020. While they currently only make up around 7% of the donor population, these numbers will quickly change as they gain greater presence in the workforce and their spending power increases dramatically. Nonprofits are focused on meeting the needs of the changing demographics within donor communities.

Source: Blackbaud, “2013 The Next Generation of American Giving”

We know that millennials prefer to bank with mobile apps, split bills using Venmo, and pay at the POS with mobile devices; so, it’s no surprise they have a greater appetite for new fundraising solutions than other generations. Blackbaud’s report confirms that millennials lead all other generations with their propensity for new payment channels, stating that nearly half would give online and just about two-thirds would give via a smartphone or tablet. However, Boomers represent 42% of total giving and 40% of their generation still prefer to make donations via mail. Nonprofits need to contend with the varied channel preferences of the changing demographics of their donor community.

One emerging fundraising channel that has gained prominence are crowdfunding platforms and peer-to-peer (P2P) platforms. Blackbaud reports that almost 30% of Generation X and Generation Y have given through these platforms with over 75% likely to do so in the future. Nonprofits are leveraging this trend by either integrating these platforms into their organization’s website or establishing fundraising pages on popular third-party P2P and crowdfunding sites. Regardless of approach, these fundraising platforms appeal to the social nature of younger donors and nonprofits need payments providers that can support the unique requirements (i.e., payouts) of this channel.

Challenge #3: Inevitable year-end surge of donations

Year-end giving is by far the most productive time of year for fundraising. Not only do nearly 30% of all donations occur in December, but 12% of annual donations occur on just the last 3 days of the year. This presents an enormous challenge for nonprofits as a majority of donations still occur offline, including direct mail. For checks mailed the last days and weeks of the year, nonprofits may have to wait 3-4 business days for the checks to arrive and another 2-3 days for the checks to clear. To further complicate matters, some checks still have the potential to bounce up to 3 or more weeks later.

Nonprofits would benefit from faster payment options, so donations received the last days of the year can quickly be processed in time to provide year-end tax receipts to donors in a more timely fashion. These organizations would benefit from transitioning mailed checks to electronic eChecks or NACHA’s latest Same Day ACH offering. Too many nonprofits fail to make the most of this inevitable year-end surge of donations but can make these changes with support from their payment provider.

Source: Click & Pledge, “3 Ways Capital Campaigns Boot Your Year-End Giving Season”

Challenge #4: Fraud prevention and detection

According to the Association of Certified Fraud Examiners, the average business loses 5% of revenue to fraud every year – nonprofit organizations are no exception. Nonprofits reported approximately $2,387 billion in revenue to the IRS in 2016, so at 5%, that would roughly equate to $119 billion in lost revenue. The cost to nonprofits is significant and layered, including reputational cost, accumulated chargeback fees, and refunded stolen donation payments returned back to donors. Cash-strapped nonprofits can’t afford that kind of financial loss.

Fraudsters have found unsuspecting nonprofits to be an ideal testing ground for stolen cards. Perpetrators can verify stolen cards work by either making large donations or small, high-frequency donations to nonprofits. For large donations, fraudsters may attempt to contact the nonprofit to claim it was made in error and request a refund to their own card.

Thankfully, there are several steps nonprofits can take to minimize such risk. Nonprofits should seek a PCI-compliant payment provider to serve as their ‘first line of defense’ and help them verify legitimate cards. Trusted providers are often armed with sophisticated fraud prevention tools such as:

- Address Verification System (AVS): matching the address listed on a donation form with the address on file with the donor’s bank or credit card

- Bank Identification Number (BIN) Checking: validating donor bank accounts for ACH and debit donations

- Card Verification Code Requirement Capability (CVV2): checking the 3-4 digit verification number for credit card donations

- IP (Internet Protocol) Blocking: preventing connections from donors using a suspicious IP address

Challenge #5: Registering and retaining recurring donors

While recurring donors give about 42% more annually than one-time donors, managing these recurring donations presents unique challenges to nonprofits. With donors locked into recurring payments, retention rates improve, and nonprofits can focus more on acquiring new donors. In fact, lowering attrition rates by just 10% can improve lifetime value of donors as much as 200%, so donor retention is top of mind for nonprofits.

With a one-time gift, a card is only charged at the time the initial pledge is committed. The nonprofit collects both the donor’s personal information for transaction confirmation and tax reporting purposes and card data (including expiration date) to verify the card. Once the transaction is completed, the nonprofit sends payment confirmation to the donor but no longer has access to the donor’s payment details. The full transaction flow would have to be repeated with each subsequent donation, costing additional time and money to nonprofits.

However, like with merchants managing recurring online subscriptions, nonprofits processing recurring donations need to have payment and personal data stored for future use. The right payment partner is essential to help nonprofits retain and protect donor’s information for recurring donations. Sophisticated providers can store a donor’s payment information from the initial donation in a vault, a secure cloud-based database, and return a reference token in its place that the nonprofit can maintain. The nonprofit can then process monthly recurring donations with limited risk to them for ‘storing’ the data. Providers offering card vaulting can simplify some of the challenging aspects of processing recurring donations, such as:

- Automating the process for initiating, modifying, or cancelling recurring gifts

- Enabling flexible payment frequency (i.e., monthly vs. annual) with ease to donors

- Sending automated receipt notifications to donors with each recurring payment

Many obstacles remain even after enabling automated recurring donations – particularly the constant battle to stay ahead of expiring cards to prevent unnecessary declines the next time the card is charged. Nonprofits will ideally find themselves a provider that offers an account updater service that routinely updates the card-on-file for the donor to help avoid costly payment declines and interruptions, or worse yet, to help avoid losing donations all together. Processing recurring donations can be challenging, but the upside potential to nonprofits is tremendous. This may be the greatest challenge they face – securing a provider that can get this right.

As you can see, the payments challenges laid out remain opportunities for payments providers. These needs are being addressed both by traditional acquirers as well as an emerging class of dedicated providers uniquely focused on serving the nonprofit sector. Do these payments challenges sound painfully familiar? Does the opportunity intrigue you? If so, we would love to hear from you.