Situation

A Sub-Saharan African country had a large economy with a vibrant technology sector and a young, energetic workforce saw persistent poverty and inequality. Measures of financial inclusion were not meeting national targets and were getting worse for the most vulnerable, including low- income and women end users. Glenbrook was asked by a client to complete a year-long study to articulate the strengths and gaps in this country’s payments ecosystem and to outline recommended philanthropic interventions best suited to drive financial inclusion.

Approach

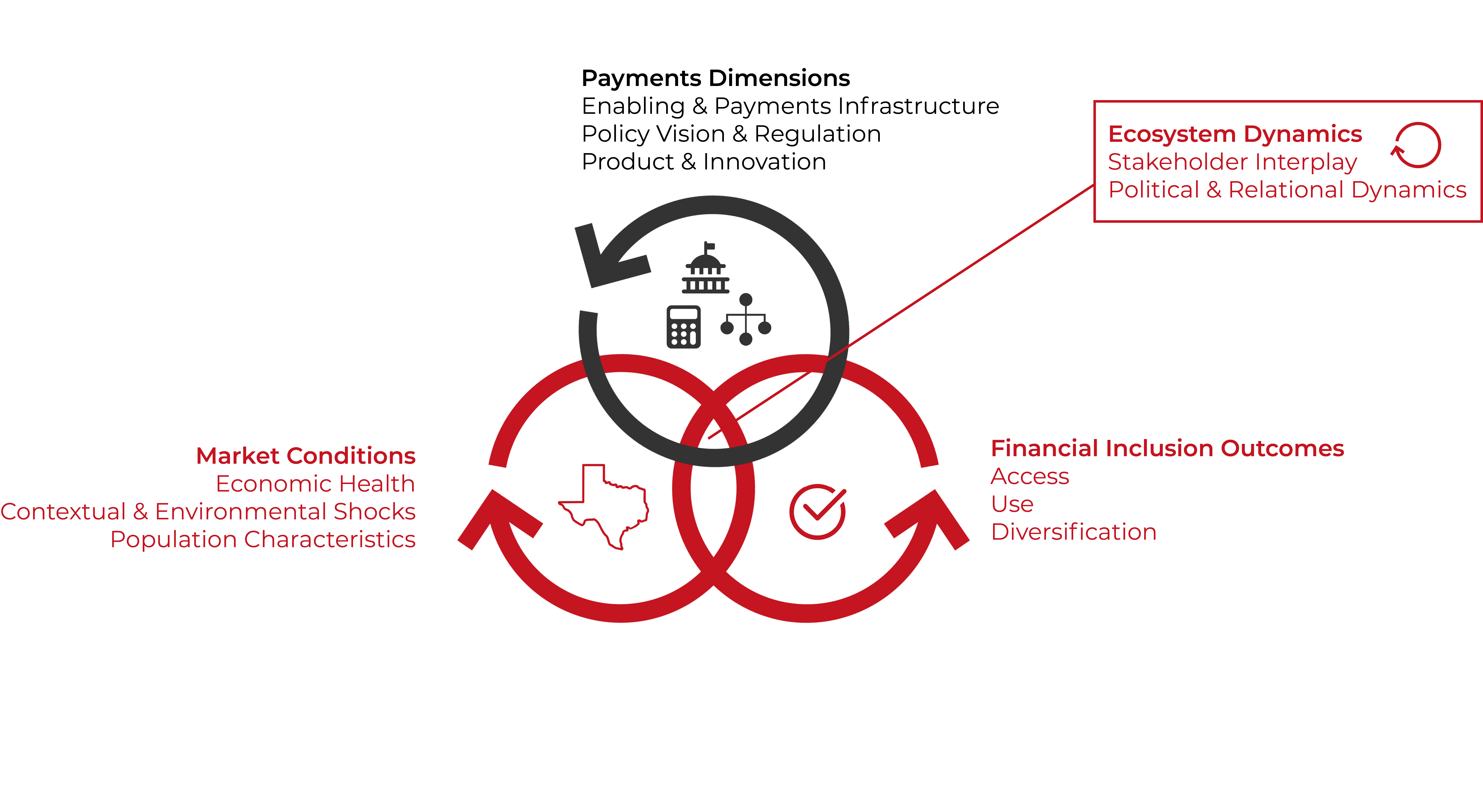

Glenbrook developed and applied a framework to assess four primary dimensions of the payments ecosystem including macro market conditions, payments dimensions, financial inclusion outcomes, and ecosystem dynamics to show the interplay of the three other dimensions together and how they work together to support (or not) financial inclusion.

Guided by the framework, Glenbrook conducted extensive primary and secondary market research, including interviews with key ecosystem participants, to draft a comprehensive landscape view as well as prioritized and actionable opportunities for philanthropic support to increase financial inclusion.

Impact

Glenbrook recommended an investment approach to support expedient, meaningful, creative action to improve financial inclusion outcomes. Our strategy anchored on expanding the payments infrastructure to better serve the needs of the poor, leveraging the support of willing (commercial) stakeholders by aligning their interests with financial inclusion goals and capitalizing on technology and business innovations to drive scale and last mile reach. Glenbrook’s recommendations were used as a key guide in directing effective application of philanthropic funds towards projects with best chances of achieving financial inclusion outcomes.