Situation

An energy company had a diverse customer mix – approximately 15% of whom were cash customers. Cash customers had unique challenges; for example, their purchases were limited by their cash in hand and they checked out more slowly than other customers. The client wanted to improve the payments experience for their cash customers and, relatedly, the company was trying to determine how to digitally engage cash customers. Glenbrook was asked to help them develop a comprehensive payments strategy, potentially including a credit offering, to support existing cash customers and drive digital engagement.

Approach

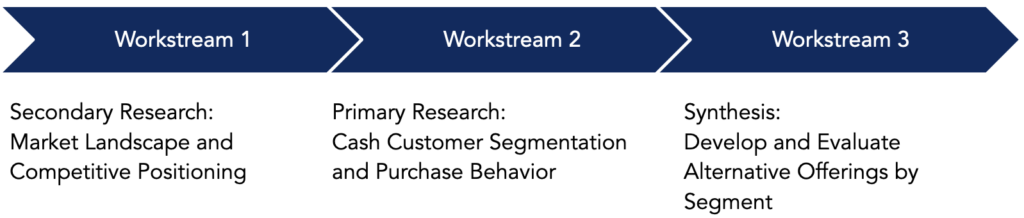

This effort required multiple, parallel efforts to arrive at a complete payments strategy. To support the client’s distinctive focus on cash customers, we conducted the following three workstreams:

Impact

We identified four cash customer segments that our client was serving. Each segment had unique needs. We identified potential digital engagement opportunities and evaluated each opportunity against a number of attributes including segment appeal, expected magnitude of improvement, feasibility, and marketing efforts. ‘Buy-now pay-later’ (BNPL) rated high across attributes for at least one of the customer segments. Ultimately, we recommended separate but overlapping strategies for this client to best engage existing cash customers.