Situation

A global payment service provider (PSP) and its financial sponsors were evaluating a multi-billion acquisition of a leading competitor. The acquisition was designed to deepen the PSP’s penetration of core retail segments in the U.S. market and its involvement in the expanding channel of integrated software vendors (ISVs).

The buyers sought Glenbrook’s assistance in understanding the target’s positioning within key vertical markets and customer acquisition channels, its price competitiveness in the SMB merchant space, and its revenue growth potential when combined with existing assets of the acquiring PSP.

Approach

Glenbrook conducted the following analyses in order to fully assess the target’s market position:

- Merchant needs assessment and evaluation of target company performance against key buying criteria

- Price benchmarking and price compression analysis

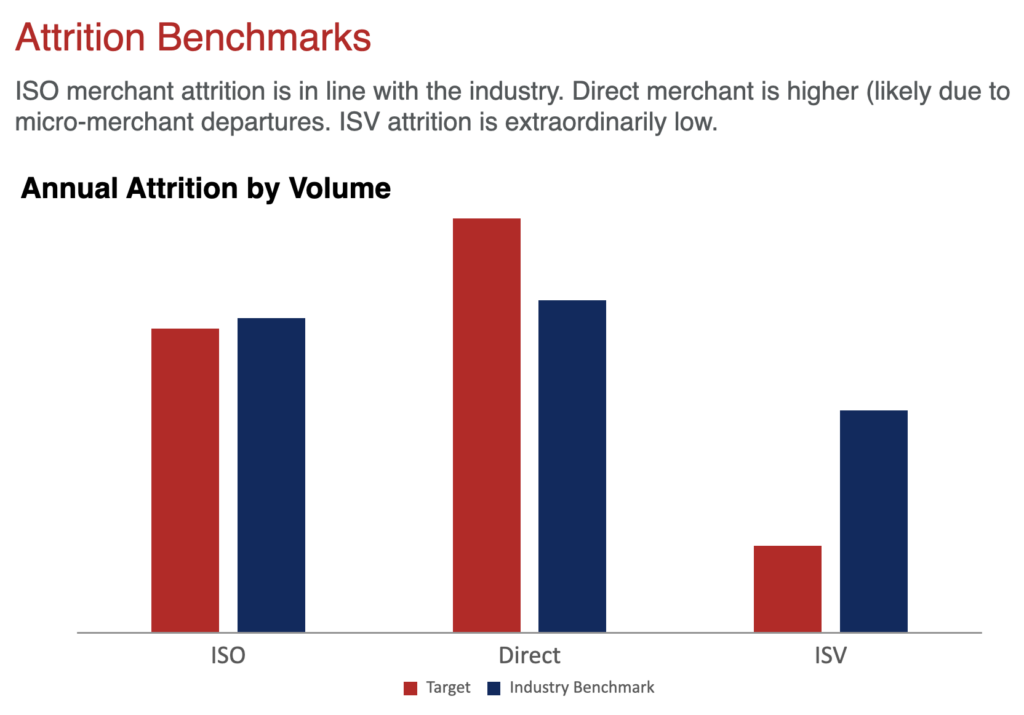

- Merchant attrition assessment (see exhibit)

- Channel performance evaluation (growth, profitability)

- Leading channel partners’ effectiveness assessment

- Post-acquisition revenue projections

Impact

Glenbrook developed a complete suite of deliverables about the target company that aligned with the approach, as described. The acquisition was completed and now represents a core line of business of the combined company.