Situation

A payments network provided noticed the emergence of fast payments in their market. The client wanted to better understand the extent to which there was an opportunity for them to provide a fast payments network and / or supporting overlays based on global implementations in key markets.

Approach

Glenbrook documented the unique characteristics of fast payments systems, shared how these characteristics determined how and where the new systems are operated, and what, if any, opportunities, and risks shaped as a result of these choices. Our approach focused on adding to the empirical knowledgebase on fast payment trends across ten markets to enhance the client’s understanding of the implications of these choices. Key questions included:

- What are the market models taking shape in fast payments?

- What are the benefits and downsides of each model?

- What specific variables or objectives are driving the trend(s)?

- What are the implications and demands of these trend(s)?

- What risks and opportunities are known or anticipated?

Impact

Findings from the research were shared with the client and a sub-segment of the findings were made publicly available. Key findings included

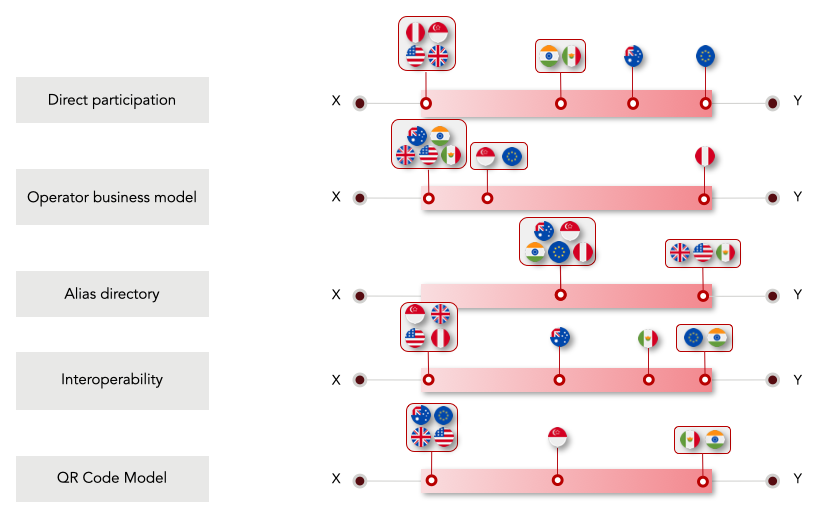

- The research demonstrated the range of implementation approaches across several dimensions.

- The research found a significant diversity in the models as they were implemented and highlights a general (but not absolute) trend toward development of thicker fast payments solutions and functionality at the core platforms/ schemes.

- Additionally, the study found that the “build it and they will come” philosophy is effectively obsolete. Financial institutions need more technical support compared to prior iterations of interbank systems, or the fsat payments system implementations risk languishing without large scale adoption.

- The nature of scheme ownership (commercial versus government) varies significantly across implementations but the role of the operator as a technical provider is generally performed by a commercial entity.

- There is typically only one core open-loop fast payments system in each market, though this varies by context.

- No single decision determines large-scale fast system usage, the study suggests industry preparedness, interoperability, and end-user experience are key determinants of platform growth. Similarly, there was no single formula for success and new industry collaboration models are needed to ensure success of fast systems.