Situation

A global retail bank was in the process of a multiyear digital transformation. As part of this transformation process, the bank wished to create an open banking API offering for internal users and external clients. As it developed this offering, the bank recognized differing approaches to open banking and levels of open banking maturing across the global markets it operated in and sought to find a way to balance the global and local uses across these disparate geographies.

Glenbrook was asked to help the bank develop and prioritize its API roadmap to ensure it aligned with capabilities that were most valuable to its target internal and external users. The focus also included developing an approach to monetizing the APIs created.

Approach

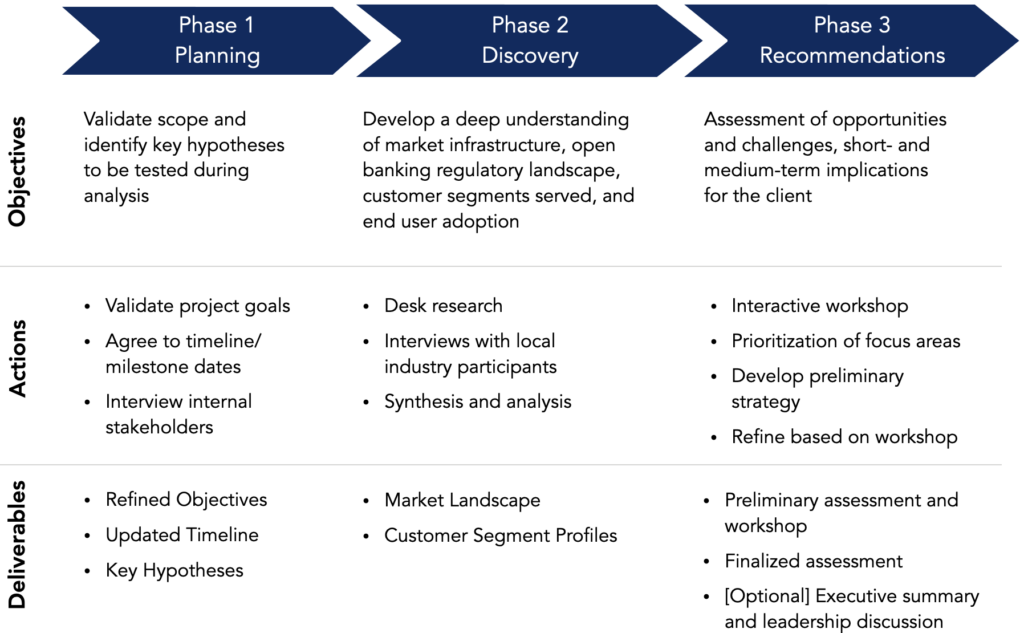

Glenbrook supported this retail bank through multiple workstreams. We interviewed stakeholders to understand strategic contexts, motivations, and identify hypotheses to be validated. We performed desk research in priority markets and spoke with key customers to validate their needs. These project activities were organized by the following phases:

Research efforts culminated in an assessment of open banking opportunities and challenges in priority markets, as well as roadmap recommendations. The assessment was presented to key internal stakeholders in a half-day workshop.

Impact

This effort resulted in three key outcomes:

- An external perspective on open banking market requirements and potential monetization opportunities

- Profiles of distinct customer segments and their needs, motivations, and desired capabilities and functions

- An understanding of the relative priority of potential solutions by segment and geography, based on the customer profiles produced by Glenbrook.