Situation

A global omni-channel merchant had a number of strategic payments objectives, including 1) increase subscriber growth and retention 2) support international growth 3) maintain redundancy and resiliency and 4) maximize authorization rates. Glenbrook was asked to develop strategic recommendations that aligned with these goals.

Approach

Glenbrook used our established and disciplined methodology for conducting a “Payments Acceptance Strategy” engagement that assesses critical areas of payments functionality against current industry best practices. Key guiding questions included:

1. What is the company international growth strategy? What countries are priority? Which payment methods should we support to maximize growth in these countries? Which providers support these payment methods?

2. Should the company use a single payment provider or continue to use a multiple-acquirer configuration? What specific capabilities is the company looking for that we do not have access to today? What is the optimal configuration?

3. What is the optimal tokenization strategy to support a secure, agile payment environment?

4. What is necessary to enable growth by optimizing retry strategies? Should this be managed by a third-party or in-house? What are the features the company requires?

5. Should the company continue to use existing partners? What other partners should the company consider and why?

6. What is the optimal team configuration to support the payments strategy?

We then formulated specific recommendations for improvement and optimization of various functions, along with potential changes to vendor selection.

Impact

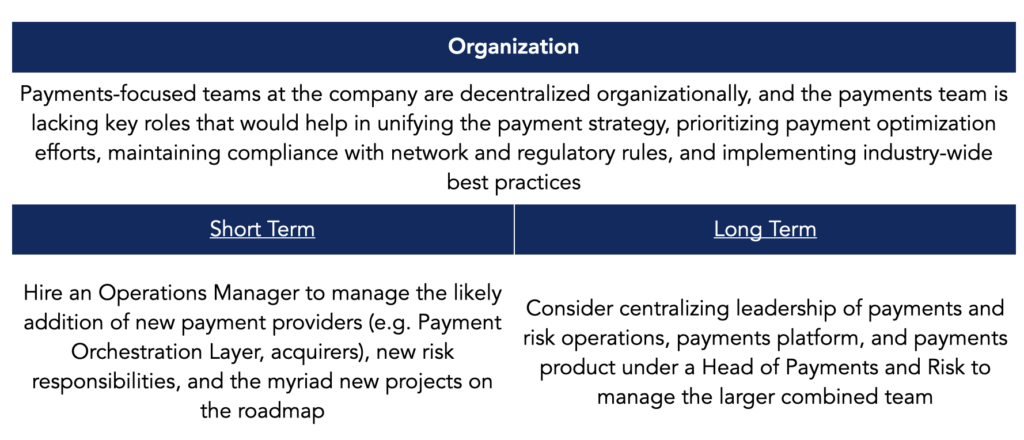

Glenbrook recommended a series of short- and long-term goals to optimize the company’s payments acceptance. Recommendations covered categories including architecture (i.e. payments orchestration), partner providers, international, involuntary churn, and organizational. An example extract from the organizational recommendations is below