At Glenbrook, international financial inclusion work has long been a major focus area. Given the challenges racial equity concerns raises for the U.S., Glenbrook as a firm has returned our focus to financial inclusion here at home.

To begin that examination, we look at the state of financial inclusion in the US and what are companies doing to address it. We look at some of the reasons why people remain financially excluded and why this remains a problem. In subsequent posts Glenbrook will delve further into the myriad solutions directed at financially underserved and vulnerable consumers.

Financial Inclusion in the U.S. Today

According to a 2018 Federal Reserve Report, six percent of American households are considered unbanked. Another 16 percent of American households are considered underbanked. These people must reach outside of the banking sector to meet their financial service needs. This represents 22 percent of American households, or about 56 million adults.

Definitions

Unbanked: No one in the household has a checking or savings account.

Underbanked: While they have a bank account, these households have used an “alternative financial service” like a check casher, non-bank money order, or payday loan in the last year.

Why Are So Many Americans Unbanked?

In its biennial survey of unbanked households, the FDIC asks respondents why they are unbanked.

The most frequent reason, cited by nearly 50% of respondents in 2019, was “not being able to meet the minimum balance requirements set by banks.” This makes sense when we consider that “free” checking accounts often require a minimum balance or deposit activity to stay “free.” For example, Bank of America’s Advantage Plus checking account has a $12 monthly maintenance fee if deposit activity falls below $250 every month, or the daily minimum balance is lower than $1,500.

For low-income Americans living paycheck-to-paycheck, meeting those minimum balances is often not practical.

The second most cited reason may be more challenging for bankers to address. Thirty-six percent of respondents indicated a lack of trust in banks as a factor in not having a bank account. Distrust in banks has actually increased since the FDIC began asking this question in 2015. Over just four years, the percentage of respondents who listed not trusting banks rose from 30 to 36 percent of respondents.

This “I don’t trust banks” answer suggests that even if banks respond by eliminating minimum balance requirements and overdraft fees, there will still be a portion of the unbanked population that will continue to distrust financial institutions.

These gaps have opened up opportunities for fintechs to offer bank-like services without the baggage of “banking’s” reputation.

Why the Bank Account Gap Matters

When designed with low-income consumers in mind, bank accounts support financial security. Direct deposit, deposit insurance, debit cards, free ATM withdrawals, and access to affordable credit products like mortgages and auto loans, all contribute to financial wellbeing.

Let me be clear that having a bank account is not a cure for financial vulnerability. Wage growth has lagged well behind the rise in basic household costs during this century. Having a bank account isn’t going to make any of that go away, but the lack of one increases costs and challenges.

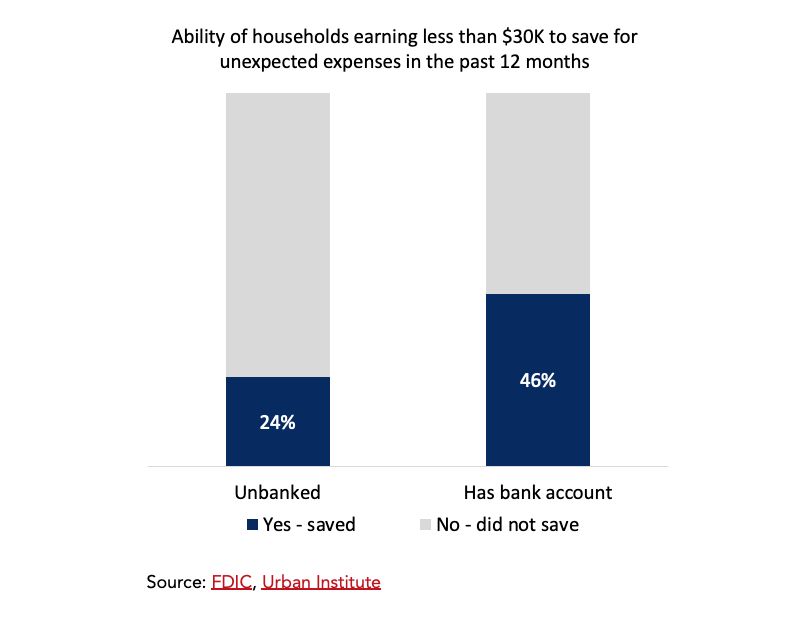

Without a Bank Account, It’s Harder to Save

The FDIC data shows that, among American households earning less than $30,000 per year, being unbanked is correlated with a significantly lower savings rate than for banked households. 46% of banked households reported saving for unexpected expenses in the last 12 months compared to only 24% for those without.

Why this correlation with higher reported savings? One hypothesis is that it is harder for the unbanked to save because the alternatives like cash or valuables carry significant risk of theft or loss. You could also save using a prepaid card, and while this may be a better option than cash, most reloadable prepaid cards come with bank-level monthly fees.

Alternative Services Cost More

Those without bank accounts are also much more likely to turn to alternative financial services that often come with hefty fees. Take check cashing for example. According to the FDIC data from 2019, those without bank accounts were almost 8 times more likely to report using non-bank check cashing in the past 12 months compared to those with bank accounts.

Check cashing, together with payday lending is a big $11B business. While individual fees vary wildly, even one of the more affordable check cashing options, Walmart’s Money Center, charges $4 to cash a check of up to $1,000. If a customer cashes a sub-$1,000 paycheck every other week, this still comes out to over $100 a year in check cashing fees. Fees would double if the paychecks were for more than $1,000 each.

Contributing to Inequality

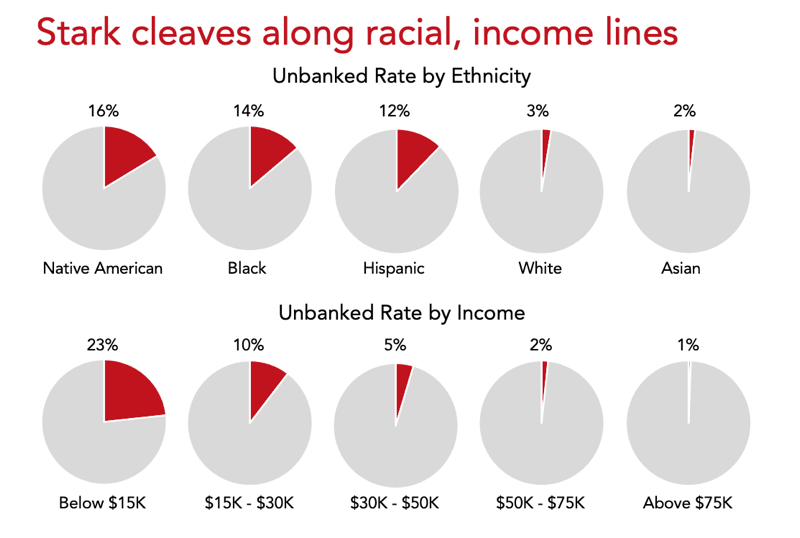

Given the savings implications and the need to turn to these often expensive alternative financial services, being unbanked is another factor contributing to U.S. inequality. The unbanked rates for Americans of Color and low-income Americans are much higher than for White or high-income Americans.

Surging Interest in These Customers

Despite the starkness of the problem, the good news is that there has been renewed interest in serving the unbanked and the underbanked. An article recently published in American Banker describes how entrepreneurs are increasingly seeking to launch banks to cater to Black and Hispanic communities.

Fintechs are also becoming increasingly attractive bank alternatives. There are a growing number of fintech / bank partnerships — like Cash App and Lincoln Savings Bank — that provide bank-like features to unbanked fintech customers. The fintech manages the customer relationship; the bank operates in the background to provide ACH routing numbers, card network sponsorship, and FDIC deposit insurance. Through such partnerships, fintech customers get “kind-of” a bank account, likely without even knowing it.

Some customers may wish to work directly with a bank and don’t mind transacting digitally. For this group, the rise of digital-only banks has provided a host of options that tend to be low or no fee, often without minimum balance requirements. For example, Chime offers a checking account option with no monthly fee.

Consumers today have more alternatives to the conventional bank offerings of accounts, credit cards, direct deposit, and bank portals than ever before. Next gen fintech alternatives include mobile wallets, neobanks, buy now – pay later installment lending, and earned wage access are filling some of the gaps we have discussed. The traditional “alternatives” of the past like cash, payday loans, check cashing, and money orders are seeing declining use as these next generation solutions emerge.

The jury is still out on whether these next gen alternatives can solve the financial inclusion problem in the US. What is certain is the amount of momentum and excitement around this issue today.

Stay tuned for further posts on financial inclusion in the U.S. and what is being done about it. And reach out if you’d like to discuss this important concern with us.

About the Author

Laura Dreese is a Senior Associate with Glenbrook’s Global Practice. She comes to Glenbrook with 8 years’ experience working in microfinance credit and technology solutions on a global scale. Laura holds an MBA from Columbia University and a BS from the University of Wisconsin Madison.